- All

- Aerospace/Defense

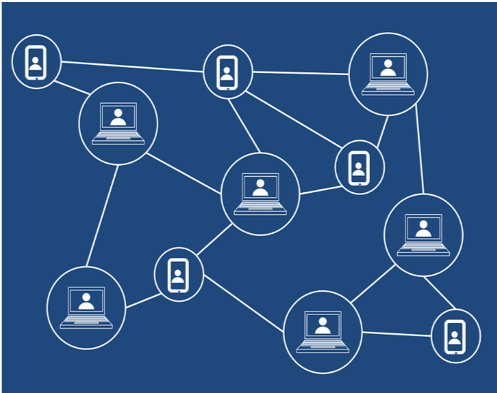

- Blockchain

- CapitalRaises

- CastlePlacement

- Construction

- Cryptocurrency

- Cryptocurrency

- Data Sentence

- E-Commerce

- Energy

- Equipment leasing

- Financial Services/FinTech

- Healthcare/HealthTech

- Housing Market

- Insurance

- Investmentbanking/CrowdFunding

- Lenders

- Manufacturing

- Payments

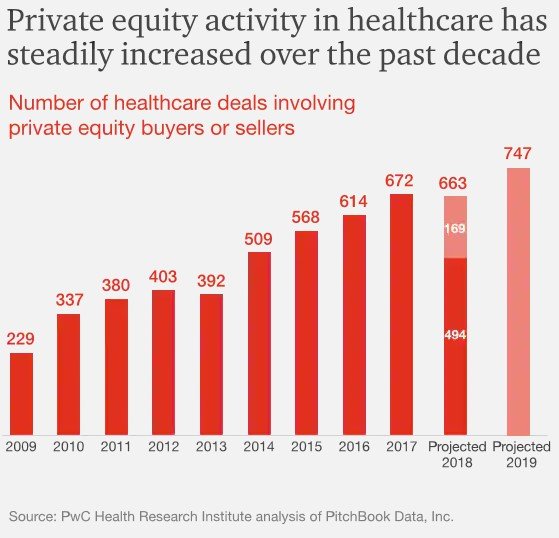

- Private Equity

- Real Estate

- Technology

- Transportation

- Venture Capital

- WealthManagement

Oil and Gas Industry Outlook

Oil and Gas Industry Outlook The global oil and gas industry generates hundreds of billions of dollars globally each year. The US is the largest producer of natural gas on earth, and one of the biggest producers of oil. There are five important trends to watch. The United States is now the largest producer of oil and natural gas in…

Real Estate

Real Estate Although real estate valuations are at historical highs, the asset class could still be advantageous for investors. The large cash flow contribution to overall returns could provide for stable returns. In addition, recent changes to the code have improved the tax treatment for many real estate investors. Sensible leverage could boost equity returns, as real estate continues to…

Oil and Gas Industry Outlook

Oil and Gas Industry Outlook The global oil and gas industry generates hundreds of billions of dollars globally each year. The US is the largest producer of natural gas on earth, and one of the biggest producers of oil. There are five important trends to watch. Oil demand keeps increasing The US uses 19 million barrels per day, and China…

CPGOapp Investor Timing

CPGOapp.com When should you contact new investors/lenders for your company? The short answer is before you need it. Conventional Wisdom “you should be fundraising or not fundraising” Fundraising is a time consuming and distracting process. It is critical to be fully prepared, and there is nothing worse than a stale deal. However, getting new investors/lenders comfortable takes longer than…

CPGOapp

CPGOapp.com 5 Reasons to use CPGOapp.com - fast, inexpensive way to connect with investors and lenders provided by Castle Placement - the premier private capital investment bank matches institutional investors/lenders for your company granular investment criteria and precise matching technology 64,500 investors and lenders contact info (email, Linkedin, website, phone, address, portfolio info, AUM, etc.) automated emailing first 10 matches…

Spotting the Trends in the Transportation Industry

Spotting the Trends in the Transportation Industry Transportation, passenger and freight, is one of the largest industries in the world. Overall, S&P expects the industry to enjoy “continued moderate revenue growth (averaging around 5% for most subsectors) and stable EBITDA margins for 2019.” While air traffic remains strong with moderate growth forecasted, S&P expects rail to outperform. In the US,…

Second-Tier Cities Are Becoming the Key Real Estate Markets

Second-Tier Cities Are Becoming the Key Real Estate MarketsSecond-Tier Cities Are Becoming the Key Real Estate Markets Demographic changes in smaller U.S. cities provide real estate investors with significant new opportunities. Many secondary and tertiary cities are seeing population growth and becoming revitalized. Meanwhile, larger cities are growing slower. Over the next 5 years, PWC projects that “the populations of New…

Recreational Tourism

Recreational Tourism The recreational tourism and outdoor adventure segments are growing fast. They play an important role in local and national economies, with annual revenue of over $500 billion in the U.S. alone. The five fastest growing segments are RVs, fly fishing, standup paddle boarding, rifle hunting and cross-country skiing – others include biking, caving, climbing, hiking, downhill skiing and…

E-Commerce

E-Commerce The world has become a global marketplace thanks to the Internet, ecommerce, computers, smartphones and tablets. Accordingly, the definition of “traditional retailer” has changed dramatically. Retailers, both old and new, are deploying enormous amounts of capital to expand online sales. These investments are paying off handsomely. US consumers alone spent $517.36 billion online in 2018 (15.6% YoY growth). Market…

Internet of Things

Internet of Things The Internet of Things is a massive space that is attracting huge private equity and debt capital infusions. The term IoT is mainly used for devices that wouldn’t usually be generally expected to have an internet connection, and that can communicate with the network independently of human action. It is the network of devices such as vehicles…

HealthTech Continue to Blur in 2019

HealthTech Continue to Blur in 2019 The global health care industry doesn’t show any signs of slowing down in 2019. Aging and growing populations, greater prevalence of chronic diseases, and exponential advances in innovative, but costly, digital technologies continue to increase health care demand and expenditures. According to PwC’s report on PE investment, the pace of private equity firm investment…

Fintech Industry Trends

Fintech Industry Trends Technology has been an increasing challenge and threat to traditional financial services that were once highly dependent on salespeople, desktops and large institutions. FinTech democratizes complicated and institutional processes and moves towards mobile services. It provides faster, less expensive, and more secure service. According to KPMG, global investment in fintech companies in 2018 hit $57.9 billion across…

Supply Chain Digital Revolution

Supply Chain Digital Revolution Annual U.S. business spending on logistics now exceeds $1.5 trillion, and the U.S. is still the largest consumer market in the world. Retailers are under enormous pressure, and their number one goal is to better facilitate the flow of goods and improve the customer shopping experience. In short, to survive retailers need to dramatically improve their…

2018 Unicorn Market

2018 Unicorn Market In 2018, 53 new companies reached Unicorn status, up 83% from 2017 (CB Insights). Most of these companies were US-based. Although the US still dominates the Unicorn market by number of companies, 48% percent of the market value were from non-US Unicorns. China has become the second largest Unicorn market – 30% of the global market.…

Castle Placement Named Exclusive Placement Agent for M3W Fuel

MANHATTAN, N.Y. – Jan. 14, 2019 – PRLog — M3W Fuel Corp (“M3W”) announced today that it has engaged Castle Placement as its exclusive placement agent to raise $34 million of debt to develop refineries and scale its platform. Based in Calgary Canada, M3W specializes in modular refineries, spearheading micro refining processes. This helps improve scalability, profitability and reduce build time – which translates into…

Castle Placement Named Exclusive Placement Agent for CyberSpa

NEW YORK – Dec. 21, 2018 – PRLog — CyberSpa, LLC announced today that it has engaged Castle Placement, LLC as its exclusive placement agent to raise capital to support rapid expansion of its growing service provider network and a robust advertising campaign. CyberSpa is a U.S. software technology company focused on dramatically improving personal computer performance security and longevity, managed by a skilled team…

Castle Placement Named Exclusive Placement Agent for Colorado Homes

NEW YORK – Nov. 27, 2018 – PRLog — Colorado Homes, LLC announced today that it has engaged Castle Placement, LLC as its exclusive placement agent to raise capital for the development of condos, homes, hotels, and commercial properties in Colorado. Colorado Homes plans to fund four ripe initial projects including an 82-unit luxury condominium in Avon (at Base of Beaver Creek Access Road), 129…

Castle Placement Named Exclusive Placement Agent for Vivi Holdings, Inc

MANHATTAN, N.Y. – Nov. 26, 2018 – PRLog — Vivi Holdings, Inc. (“Vivi”) announced today that it has engaged Castle Placement, LLC as its exclusive placement agent to raise $200 million of capital to fund growth. ViVi is a proprietary financial ecosystem that provides financial services to the unbanked and underbanked. It is initially focused in Brazil and the US, with plans to expand globally.…

Castle Placement Named Exclusive Placement Agent for +/-$16 million of equity for Wally Walls

NEW YORK – Nov. 20, 2018 – PRLog — Insulated Wall Holdings, LLC (“Wally Walls”) announced today that it has engaged Castle Placement, LLC as its exclusive placement agent to raise $16 million of equity to expand operations to meet sales for their lightweight, energy efficient wall systems. Wally Walls provides structurally insulated modular walls for commercial development and homes. They perform design assist services,…

Castle Placement Named Exclusive Placement Agent for Transit Innovations

MANHATTAN, N.Y. – Nov. 16, 2018 – PRLog — New York – November, 2018. Transit Innovations, LLC (Transit) announced today that it has engaged Castle Placement, LLC as its exclusive placement agent to raise capital for a commuter rail mass transit system (“E-Way”) using existing freight train tracks, and high-density real estate development for the greater Milwaukee, Wisconsin area, in partnership with Bombardier Transportation. Bombardier…

Castle Placement Named Exclusive Placement Agent for Oleum Partners

New York – August 31, 2018. Oleum Partners, LLC announced today that it has engaged Castle Placement, LLC as its exclusive placement agent to raise capital for the development of oil and gas assets. Oleum is a North American energy company managed by a skilled team with a strong track record, led by dedicated and proven energy professionals, each with…

Blockchain in Media and Entertainment

Blockchain in Media and Entertainment As a decentralized network that ensures security and transparency of transactions, blockchain has become an emerging technology with increasing influence, indicated by the significant growth in cryptocurrencies and blockchain applications. Blockchain technology is now being integrated into many industries including media and entertainment, creating exciting solutions to real problems, and possibilities for new usages. Various…

Modular Construction Market

Modular construction has proven to be innovative, cost effective, and efficient, eliminating delays and costs due to weather or other natural circumstances. It is also environmentally-friendly, and produces less waste (most products are recycled in the factory). The modular construction market is expected to grow significantly in the next ten years. Builders are trying to find more efficient ways…

Fix and Flip Growth

Companies such as Goldman Sachs, Zillow, Redfin, and other massive players have recently entered the fix and flip market. Last year, Goldman Sachs bought a commercial lending platform, Genesis Capital, for professional residential real estate developers, allowing the firm to fully enter the fix and flip space. In addition, Zillow and Redfin have started to buy homes and make the…

Waste-to-Energy Trends

Waste-to-Energy Waste-to-Energy (WTE) technologies are becoming increasingly important across the globe. As municipal solid waste (MSW) increases in developing and emerging countries, there are more public concerns regarding its environmental and health impact. Currently, about 70% of total MSW ends up in landfills or dumpsites which can contaminate soil, ground and surface water, and emit greenhouse gasses.…

Highlights from the Debevoise & Plimpton – Castle Placement Webinar

Highlights from the Debevoise & Plimpton – Castle Placement Webinar Over $24bn (private equity, venture capital and ICOs) was raised by U.S. Fintech companies in 2017, up from $19.7bn in 2016 FinTech venture funding reached a record level in the 1st quarter of 2018 There are 15 U.S. FinTech Unicorns valued at $41 billion Big banks are actively investing in…

Artificial Intelligence in Investment Banking

Artificial Intelligence in Investment Banking Artificial intelligence is becoming a game changer in investment banking. Barclays is developing an AI system for customers to speak to a device to receive transaction information. UBS recently announced that is using robots on the trading floor to improve trader’s performance. JP Morgan recently introduced AI technology, COiN (Contract Intelligence), a platform designed to…

Co-Working Space on the Rise

According to recent surveys, 44% of corporations are already using flexible office space and 65% of companies expect to use co-working as part of their office portfolio by 2020. What is driving this trend? First, the shared office space can keep cost lower. Perhaps more importantly, shared space gives companies the ability to more easily flex their workforces during times…

Ups and Downs of ICOs

The popularity of ICOs skyrocketed in 2017, raising more than $5.6 billion. There have been several success stories, one of which was Bancor which raised $153 million last year, largely because it appears to be making meaningful progress linking cryptocurrencies to an autonomous and decentralized liquidity network. The Bancor protocol allows tokens to be instantly convertible for one another at…

2018 Construction Trends

Construction markets are expected to continue to improve in 2018. Spending is expected to rise 5.6% to $1.3 trillion, and much of the increase is expected to come from commercial and infrastructure markets. The Trump administration is looking to pass an infrastructure plan and that could drive construction growth further in 2019 and beyond. Given the improving fundamentals and the…

Castle Placement See Resurgence in Capital Raising for Conventional E&P Companies

New York – January 26, 2018. Castle Placement, a technologically innovative boutique investment bank, announced today that it has seen a boost in energy companies seeking capital for conventional oil and gas exploration, development and production. For the past several years, energy investors and independent operating firms have been favoring unconventional shale development over conventional plays, leaving fewer competitors in the latter and…

Health Care Tech Investments: 2018 Update

Investors’ interest in healthcare tech remains significant with artificial Intelligence and blockchain technology continuing to help patients and the broader healthcare industry. Both Microsoft and Google have started incubator programs supporting healthcare focused artificial intelligence start-ups. Both Microsoft and GV (formerly Google Ventures) recently invested in the following healthcare companies that are developing artificial intelligence applications: DNAnexus – combines expertise…

SEC’s Focus on ICOs

CoinSchedule reported that in 2017 234 ICOs and token issuances raised $3.7 billion, a significant increase from the ICOs in 2016 that raised less than $100 million. The SEC (and, we believe, the IRS and CFPB) is focused on this space. Last week the SEC warned of the risks of investing in unregulated digital currencies as there is “less…

Bitcoin’s Run

Bitcoin remains white hot – the cryptocurrency is up more than $3,000 over the last week or so, surpassing $11,300 earlier this week. There are obviously many supporters of the leading cryptocurrency – some believe its scarcity value supports the rapid rise in the bitcoin price. 32% of young people prefer bitcoin to stocks and 42% of millennial males said…

Oil and Gas Opportunities

Oil prices have been on the rise due to tensions in the Middle East and the Venezuela economic crisis. Last week oil prices hit a two year high and this week traded off due to a lower outlook for demand growth from the International Energy Agency and weaker than expected economic data from China. All this volatility does not surprise…

Millennials’ affect on the housing market

Millennials were more negatively affected by the financial crisis than other generations as they were in the early part of their careers and didn’t have the savings to withstand the crisis. The combination of stagnant wages, lack of jobs/savings, and rising home prices meant that millennials were unable to afford to buy homes after the downturn (we do believe some…

PE investments for 2017

There are several trends that we are seeing in the private equity space and the signals appear to be somewhat mixed. While fundraising is at record high levels, deal volume is down 11% for the first nine months of the year. Though overall deal volume is down, certain sectors are still generating a lot of interest. PE Exits have also…

Venture Capital Spending 3Q 2017

It appears that venture capital spending will reach the highest levels of the last decade. According to PitchBook-NVCA Venture Monitor, several key trends have emerged in the industry. Larger amounts of capital into fewer companies Total investments have totaled $61.4 billion year to date. Venture investors put to work $21.5 billion to more than 1,699 venture-backed companies, or just above $12.5 mm…

UBER’s Xchange Leasing

After initially looking to sell its 40,000 car leasing business, Uber is now shutting down Xchange Leasing. The fact that Uber is shutting the business shouldn’t be that surprising since the company is reportedly losing ~$9,000 per car (meaningfully more than the initial expected loss of $500 per vehicle). The company plans to honor its existing leases until they expire.…

UK Consumer Credit

It looks like UK consumer credit growth may be slowing down, falling to 9.8% from 10%. Factors that may be contributing to this trend include onerous regulations placed on banks and declining confidence in the UK due to Brexit. The Bank of England has taken action to ensure that banks will be well positioned in the event of a downturn. The…

Hurricane Harvey’s Impact on Houston’s Residential Real Estate Market

Hurricane Harvey’s impact on the people of Houston has been and will continue to be devastating for the foreseeable future. In the greater Houston region, Hurricane Harvey has caused between $30 and $40 billion in residential property damage including 30,000 to 40,000 homes destroyed and 196,000 homes damaged. (Source: CBRE/Community Impact Newspaper; Moody’s Analytics) Many of the damaged homes will…

Defense Technology Industry and Venture Capital/Private Equity

The defense technology industry has been getting increased attention from both the government and private investors. U.S. Defense Secretary James Mattis recently stated that he is looking for help from private technology companies to make the US military as effective as possible. The Republican administration recently tripled funding for the Defense Innovation Unit Experimental (DIUx), a relatively new division within…

The ICO Gold Rush – The Future of Fundraising?

One of the hottest trends among high-tech startups is using cryptocurrency to raise capital through initial coin offerings (ICO). Over $1.2 billion has been raised this year, and in July Tezos raised the largest ICO to date for $230 million. Tezos’ raise came off the heels of the Bancor raise for $153 million. Although the effort experienced some hiccups with…

Autonomous Vehicles Update – 2017 Capital Raises

Technological advances for autonomous vehicles are causing meaningful changes in the auto industry. Both financial and strategic investors (i.e OEMs, tech companies, auto suppliers, etc.) are allocating a significant amount of capital to the sector. Over $1 billion was invested in small independent auto tech companies in 2016 – a 91% increase from the previous year, according to CB Insights. Even more is expected for 2017 – see below for notable 2017 capital raises. Last year, Apple tapped a key…

Big Victory for Bankrupt Debt Collection Industry

In a recent Supreme Court case—Midland Funding, LLC. V. Johnson, No. 16-348—the court declared that the statute of limitations doesn’t necessarily bar a creditor from seeking payment for an obligation through a bankruptcy claim. The case began when Midland Funding filed a claim to collect a $1,900 credit-card debt from Aleida Johnson. Although Midland’s claim was originally dismissed, Johnson then…

Oil & Gas Drilling Increases – May M&A Update

Many oil and gas upstream companies are increasing their domestic capital spending, especially in West Texas. Relative stability in crude oil prices and greater visibility on profit margins from stacked plays and new technology have led companies to ramp up capital spending plans for 2017. A recent Bloomberg article indicates that U.S. drillers are increasing 2017 capital spending by 32%…

Virtual and Augmented Reality – May 2017 Update

Virtual and Augmented Reality (VR/AR) has been growing dramatically and there is little doubt it will continue to do so over the longer term. SuperData Research projects virtual reality to grow to $38bn by 2020 and Goldman Sachs estimates that VR/AR could generate $45bn in annual revenue by 2025 (or even reach $110bn, surpassing the TV market in an upside…

Equipment Leasing Outlook 2017

The outlook for the Equipment Leasing industry and M&A activity appears positive for 2017 and beyond. Non-residential construction markets continue to improve and the new administration’s talk of an infrastructure spending plan of as much as $1 trillion could drive additional growth longer term. Additionally, a more favorable regulatory environment has construction industry professionals optimistic about the future. John…

SFIG Vegas 2017 Conference – Synopsis

The Structured Finance Industry Group had their SFIG Vegas 2017 Conference at the Aria Resort & Casino in Las Vegas from February 26th to March 1st – around 7,000 ABS market professionals attended including investors, issuers, financial intermediaries, regulators, law firms, accounting firms, technology firms, rating agencies, servicers and trustees. The impact of finance regulation was the hot topic…

Peer-to-Peer (P2P) Dominance

The peer-to-peer (P2P) payment industry, through digital platforms such as Venmo and Google Wallet, has become a preferred method for monetary transactions as a younger tech-savvy generation ages and gains more spending power. The question facing the industry is how to monetize the inevitable dominance of this technology from a generation that has come to expect these types of services for…

Fintech: Payment System

Two years ago the Federal Reserve released Strategies for Improving the US Payment System, a plan that was intended to improve the payment system by making it faster, more secure and more efficient. Since this plan was released, the Fed has collaborated with key stakeholders to implement strategies from the plan to ensure that the US payment system keeps up…

The US oil and Gas Industry Hopeful after Inauguration

The oil and gas industry in the United States gained a new ally when Donald Trump was sworn in as the 45th President on January 20th. The President has promised to reverse existing policies that restrict energy development projects on public lands, which will result in more domestic oil & gas production and make the US more energy independent. The…

Growing Trends in Venture Capital for 2017

Over the course of the past year, Venture Capital (VC) firms have become more cautious when looking to invest in startups and early stage companies. This made it more difficult for companies to receive funding and, in conjunction; the technology IPO market was weak until the end of the year. However, because funding for VC firms was strong, there is…

Fix and Flip on the Rise 2017

In 2016 the number of investors fixing and flipping homes hit its highest level since 2007. 2017 is expected to see continued growth with estimates of $48 billion in total sales. Rising home prices, low interest rates and favorable lending terms have helped fuel the resurgence. Big banks, including J.P. Morgan Chase & Co, Wells Fargo & Co, Goldman Sachs…

Trump & FinTech?

There have been heated discussions about where our country is heading under the Trump administration since the presidential election ended. In particular, FinTech, a sector with increasing significance to the economy, is watching closely to figure out where the future lies for the industry. An open internet environment, as many believe, is essential to the growth of FinTech companies. Democrats…

SoFi and Fannie Mae created a Cash-Out Refi for Student Loans

SoFi, an online personal finance company, has partnered with Fannie Mae to offer student loan borrowers a cash-out refinance option. This new loan option, called Student Loan Payoff ReFi, allows consumers to use their home equity to pay off their student debt. By paying down student debts, borrowers can experience increased financial freedom due to the lower rates of mortgages.…

Fintech Sandbox in Hong Kong

As fintech companies continue to grow and garner worldwide attention, the Hong Kong Monetary Authority decided to capitalize on this. The Hong Kong Monetary Authority is establishing a regulatory “sandbox” to enable faster trials of products and to maintain competitive versus its peer countries such as China, Australia, and Singapore in the fintech race. Effective as of September 6th 2016,…

Financial Services Innovation Act of 2016

As of today, the US may be the financial center of the world, but many believe it is lagging behind when it comes to innovation. This is partly due to the many laws and regulations financial services firms are required to follow. The proposed “Financial Services Innovation Act of 2016” will establish a regulatory framework that will provide FinTech firms and…

FinTech: To be or not to be with Strategics

JP Morgan joined hands with OnDeck Capital to help make loans available to its small business customers in an inexpensive and quick process. Bank of America similarly inked a deal with ViewPost in an effort to provide small business users with a way to manage their cash flows better. These deals are reflections of a fundamental shift in big bank’s…

Risks Associated with Crowdfunding

Fundraising with online crowdfunding platforms can be rewarding but there are risks and still many open questions. Beyond the obvious concern of fraud or misleading information provided by companies, many believe the “wisdom of the crowd” in often highly technical, early stage businesses is flawed. Many believe without a “professional lead” investor doing due diligence and negotiating terms – the…

Future of digital Payments

As digital payments such as credit cards are widely accepted nowadays, one may wonder whether the payment methods of card and non-card (for example, account to account/ACH) will move in different orbits. Will the digital payment replace the traditional payment method some day or will they just merge together and create a new hybrid payment? These are questions people are…

FinTech: Industry Valuation and Investment

Goldman Sachs values the fintech industry at US$4.7 trillion. This value has increased recently because of the large influx of VC and strategic capital in the last two years. In 2013, there were $4.05 billion of investments into FinTech. This increased over three times to $13.8 billion in 2015. The global adoption rate for FinTech, defined as the “number of…

China and Fintech

The people of China have been slowly but surely getting more involved in fintech services. Unlike in the West, where the people have been sticking more to traditional institutions where they believe it’s safer than online companies, the people of China have no issues with trusting online mediums for financial services. The Chinese are more than happy to get rid…

FinTech: Shift in Wealth Management

Many bankers are starting to embrace robo advisory. Wayne Patenaude, the chief executive of Cambridge Savings Bank, went against the norm and rather than hiring a team of traditional financial advisors, he decided to partner with SigFig, a robo advisory startup in San Francisco. He is not alone. Bank of America and Wells Fargo will deliver their robo advisory products…

The Growth of Global Fintech Investment

Lately there has been a lot of research being done on Fintech growth. This research shows that although there is a dramatic increase in the Asia Pacific region, there is a much slower growth in the UK. We can conclude from this information that China has advanced ahead of Europe, the UK and USA South and East in Fintech investment…

The Potential Impact of “Brexit” on FinTech

FinTech leadership across the United Kingdom is expressing concern that the “Brexit” vote may have a meaningful and negative impact on start-ups that operate throughout countries remaining within the European Union. The digital payment marketplace faces significant risks, with digital transfer payments that now easily move across borders highly dependent on licenses, which may now be at risk. Among the…

Artificial Intelligence in FinTech

How does artificial intelligence fit into the fintech sector? Well, technology seems to be the answer to lower costs and efficiency. Most recently, Wealthfront, Venmo and Sentient Technology have added AI capabilities to their products. AI has enabled these companies to analyze customer data to create better strategies. Although AI seems to be the direction fintech companies are headed, there…

Fintech Alt Lenders On The Hot Seat

Alternative lenders have been riding a roller coaster of late: The market reached a lofty peak in 2015, when, for example Lending Club reached a $7 billion market cap. However, that rise was followed by a rapid downhill drop, as evidenced by the 38% decline in the market value of On Deck Capital. Even more alarming, investors are now wondering…

FinTech: Dangerous Borrowing in MCA

Borrower’s practice of “stacking” loans represents a serious challenge to Fintech lenders. Stacking occurs when a borrower rapidly takes out multiple loans, either to accumulate financing or to repay other, older and perhaps troubled loans. While some lenders may permit stacking, it is a questionable policy as it increases the risk of borrower default. The credit crunch is partly responsible,…

Fintech: 3 Drivers

While Fintech has many faces, 3 stand out as the largest drivers in the space: the transfer of money, consumer lending, and small business lending. Mobile money refers to everything that makes shifting funds easier; from basic money transfers to mobile banking and payment processing. Smart phones are an increasingly important part of the process, as they now enable money…

FinTech Versus Traditional Banking

Is FinTech improving or threatening the basic business of traditional banks. Market participants undoubtedly have various views. Some believe that the biggest challenge from FinTech firms comes from those that provide “robo-advice and peer-to-peer lending”, which challenge banking’s historic strangle hold on saving, investing, and borrowing. Others want to bring the technology that major institutions are using, and make that…

Title III JOBS Act

Title III JOBS Act Title III of the JOBS (Jumpstart Our Business Startups) Act, which expands the capabilities of equity crowdfunding platforms by allowing non-accredited investors the opportunity to privately invest in companies, came into effect on May 16th. This is a major change for the early-stage venture capital industry, entrepreneurs, and retail investors, as the pool of potential investors…

Tink scores $10M for its virtual banking app

In another raise for mobile banking, Sweden’s Tink raised $10 million in Series B funding in a round led by Swedish investment firm Creades, and SEB Venture Capital. Tink will use the capital to expand internationally and to transform its product to transform its product to a virtual bank where users can make withdrawals and deposits. The CEO Kjell’en also…

Treasury Department wants more oversight of online lenders

The U.S. Treasury Department on May 10th issued a white paper calling for better oversight of online marketplace lenders, one day after the face of the industry — Lending Club CEO Renaud Laplanche — was forced out following a violation of the company’s business practices and lack of full disclosure to its board. The Treasury Department’s white paper on marketplace…

DAO Raises Over $100 Million

A new entity called DAO, based on Ethereum, has raised more than $100 million since late April. The company is similar to a venture capital fund except that it offers DAO tokens (voting shares) in exchange for a crypto currency called Ether. Ether is currently worth around ten dollars. All the company’s legal documents and financial agreements are hard-coded into a…

SoFi Named an Approved Fannie Mae Servicer/Seller

SoFi, a fintech finance company taking an unprecedented approach to lending and wealth management, announced that its wholly owned subsidiary SoFi Lending Corp. has been approved as a seller and servicer with Federal National Mortgage Association (Fannie Mae). “While we launched our mortgage business focused on larger ‘jumbo’ loans, the certainty and efficiency offered by Fannie Mae will enable us to…

Simply Wall St Acquires Capp.io

Simply Wall St announced its acquisition of Capp.io, a start-up that provides analysis data on US stocks. Simply Wall St uses its software to help pick stocks by converting financial data into information graphics. While both companies are in similar lines of business, Simply Wall St is expanding its market presence from Australia to the US. Together the combined companies…

Big Banks Fintech Strategy

This year, we’ve seen big banks partner with or buy out their potential finTech competitors Ally Financial bought TradeKing Group for $275 million – 4/2016 Honest Dollar was purchased by Goldman Sachs after it had just raised $3 million in venture funding BBVA bought Finnish banking start up Holvi last month “Banks are already well down the road to partnering…

Barclays Partners with Social Payments App Circle

Circle, a U.S. social payments app backed by a venture arm of Goldman Sachs, is partnering with Barclays in Britain. The partnership will provide the banking license to start offering free cross-currency payments and transfers between friends using Bitcoin. Because the cost of acquiring new customers is much lower than a traditional bank, Circle is free to focus on growing…

Why FinTech Companies Are Deciding to Stay Private

FinTech companies have good reasons to stay private these days. 2015 saw investments in FinTech companies increase more than 100%, encouraging FinTech companies to stay private longer. Social Finance raise $1 billion in multiple rounds. Additionally, public FinTech companies have had a tough time lately. LendingClub and OnDeck shares have fallen over 40% since its IPO and LoanDepot is putting…

Goldman Buys HonestDollar

Goldman Sachs, which considers itself a “tech company” is buying Honest Dollar, an Austin, Texas, company that sells retirement plans consisting of low-cost exchange-traded funds to small companies. This has been a very active year for HonestDollar which just launched in 2015 and raised $3 million in seed financing. “We set out with a singular focus: to revolutionize the retirement…

Robo-Advisors: Benefits

Robo-Advisors have captured much attention and have been the center of VC interest lately. With their ability to provide virtually the same services as traditional financial advisors ranging from investments to retirement planning. Will these automated investment vehicles eventually replace their human counterparts? Here are some of their strengths for you to consider: Low cost Traditional financial advisors usually charge…

Fintech: Lending – January 2016 Capital Raises

1. Purplebricks.com $87.6mm Growth (12/04/15) – Not Disclosed 2. fengjr.com $80mm Series A (12/15/15) – CASH Capital Investment Management; China United SME Guarantee Corporation; CITIC Asset Management; CORC Capital 3. Dashu Finance $77mm Series B (12/14/15) – PAG; Sequoia Capital 4. WorkFusion $14mm Series C (12/21/15) – Greycroft Partners; iNovia Capital;Mohr Davidow Ventures; Nokia Growth Partners; RTP Ventures 5. Progressa…

Fintech Insurance – January 2016 Capital Raises

Fintech Insurance 1. Lemonade $13mm Seed (12/08/15) – Aleph; Sequoia Capital 2. FitSense $(n/a)mm Seed (12/05/15) – Startupbootcamp InsurTech

Fintech HealthCare – January 2016 Capital Raises

FinTech Healthcare Capital Raises: 1. Clover Health $35mm Series B (12/16/15) – Athyrium Capital Management; First Round Capital; Sequoia Capital 2. HBI Solutions $12.6mm Series A (12/01/15) – Wonders Information 3. Oration $11.2mm Series A (12/16/15) – Andreessen Horowitz; Arsenal Venture Partners; Chicago Venture Partners; Data Collective; DFJ Venture; Google Ventures; TiE Angels;Work-Bench 3. GNS Healthcare $10mm Series C (12/08/15)…

Fintech Investing / Capital Markets + Wealth Management – January 2016 Capital Raises

FinTech Investing 1. Gusto (fka: ZenPayroll) $50mm Series C (12/18/15) – Not Disclosed 2. NextCapital $16mm Series B (12/17/15) – AllianceBernstein; Manulife Financial Corporation; Route 66 Ventures 3. Trulioo $15mm Growth (12/14/15) – American Express Ventures; BDC Capital; Blumberg Capital; Tenfore Holdings 4. FinTech Group $11mm Growth (12/14/15) – Not Disclosed 5. Clearpool Group $8mm Series B (12/01/15) – Edison…

KPMG FinTech 100

Fintech 100: KPMG and H2 Ventures issued the leading 50 established fintechs and the next 50 emerging stars Key Insights Funding boom – The Fintech 100 companies have collectively raised in excess of US$10 billion. Fintech is now truly a global sector – The list is comprised of 40 US companies, 20 from EMEA, 18 from the UK and 22…

Fintech Payment Processing / Management – January 2016 Capital Raises

FinTech Payment Processing / Management Capital Raises: 1. Factual $35mm Series B (12/11/15) – Altpoint Ventures; Andreessen Horowitz; Data Collective; Haystack Partners; Heritage Group; Index Ventures; Miramar Venture Partners;Tamarisk Global; Upfront Ventures 2. TabbedOut $23.5mm Series C (12/11/15) – Aeterna Capital Partners; New Enterprise Associates; Union Grove Venture Partners; Wellington Management Company 3. Masabi $12mm Growth (12/07/15) – Keolis; Lepe…

FinTech Innovation Lab – Pitches

In November, the FinTech Innovation Lab hosted 45 startups with 20 minutes apiece to pitch 80 banking executives and mentors. The FinTech Innovation Lab “Hot Themes” included: phone automated know your client data management cyber security blockchain personal financ

Fintech Lending – November 2015 Capital Raises

Fintech Lending – November 2015 Capital Raises 1. Atom Bank $128mm Growth (11/24/15) – BBVA Group; Marathon Asset Management; Polar Capital; Toscafund Asset Management; Woodford Investment Management 2. OakNorth $100mm Growth (11/13/15) – Indiabulls Financial Services 3. Earnest $75mm Series B (11/17/15) – Adams Street Partners; Battery Ventures; Maveron 4. Meili Jinrong $65mm Series A (11/05/15) – Bertelsmann Asia Investment…

Fintech: Forbes – FinTech 50

Forbes named their FinTech 50: ACORNS – App links to debit and credit cards, rounds up each purchase to nearest dollar, investing extra pennies in a portfolio of ETFs. ADDEPAR – Cloud software lets advisors analyze and manage all of a client’s assets, including hedge funds and private equity, on desktop and mobile. AFFIRM – Finances purchases with instant…

Fintech: Interview with Santander InnoVentures

– Mariano Beklinky, InnoVentures – launched a $100 million fund in July 2014 investing in seed/start-ups to later stage FinTech companies. – invested 1/3 of fund to date in 5 separate investments. – global mandate: Europe, U.S., Israel, Latin America – all across Fintech landscape: lending, payments, blockchain, etc. Banco Santander (SAN.MC, STD.N, BNC.LN) is a large retail and commercial bank,…

Fintech: Lending – JPMorgan Working With OnDeck

JPMorgan Chase (JPM)working with OnDeck (ONDK: NYSE) to create a Chase branded small-dollar business loan to be launched in 2016 leveraging OnDeck’s technology platform. OnDeck shares soared 33% on the news.

Fintech Insurance Capital Raises – November 2015

Fintech Insurance Capital Raises: 1. Innovation Broking $3mm N/A (11/12/15) – Albion Ventures 2. Beekeeper Data $0.6mm (11/10/15) – BrightStar Wisconsin Foundation;Serra Ventures; Wisconsin Investment Partners 3. RenewBuy $0.5mm N/A (11/09/15) – Mount Nathan Advisors

Fintech HealthCare Capital Raises – November 2015

Fintech HealthCare Capital Raises – November 2015 1. HealthiestYou $30mm N/A (11/12/15) – Frontier Capital 2. Solera Health $3mm (11/03/15) – BlueCross BlueShield Venture Partners; Sandbox Industries 3. HealthCrowd $2.1mm N/A (11/23/15) – 37 Angels; Band of Angels; Berkeley Angel Network; Healthy Ventures;Herlitz Capital; Startup Capital Ventures 4. GoCo.io (Amount not disclosed) (11/11/15) – Digital Insurance, Inc. 5.…

Fintech Investing / Capital Markets + Wealth Management – November 2015 Capital Raises

Fintech Investing / Capital Markets + Wealth Management – November 2015 Capital Raises 1. CircleUp $30mm Series C (11/11/15) – Canaan Partners; Collaborative Fund;Maveron; Rose Park Advisors; Union Square Ventures 2. Moneyfarm $17.2mm Growth (11/09/15) – Cabot Square Capital; United Ventures 3. Hanweck Associates $10mm N/A (11/16/15) – Argentum Group 4. CB Insights $10mm Series A (11/09/15) – RSTP 5.…

Fintech Payment Processing / Management – November Capital Raises

Fintech Payment Processing / Management – November Capital Raises 1. Bit9 + Carbon Black $54.5mm Series F (10/14/15) – .406 Ventures; Accomplice; Evolution Equity Partners; Founders Circle Capital; Highland Capital Partners;Kleiner Perkins Caufield & Byers;Sequoia Capital; The Blackstone Group 2. SteelBrick $48mm Series C (10/13/15) – Emergence Capital Partners; IVP;Salesforce Ventures; Shasta Ventures 3. Numerify $37.5mm Series C (10/22/15) –…

3 Things All Successful FinTechs Have In Common

See 11/12/15 video from Lendit USA 2015 Closing Keynote by Ron Suber, President of Prosper Takeaways: 3 things all successful FinTechs have in common: – Capital, Product and Operations Capital: – Diversified – Varied risk appetite – Ready – “Permanent” Product: – Acceptance – Ease of use – Meet the needs – Customer experience – Repeat business – New products…

The Big Chill in Fintech?

See 11/12/15 video with Matt Burton, Orchard CEO and Glenn Golman, Credibly CEO Takeaways: – Burton: “truth of the matter”… “only 6-12 [institutional] buyers of paper in [Lending Marketplace] space”… – Goldman: possibility/impact of “credit correction” and “recession” [mitigated by fintech tools for better credit underwriting]…

FinTech Unicorns – Valuation($)/Type/Country

FinTech Unicorns 1. Lufax: $10 billion / Lending (Personal Loans) + Financial Asset Exchange (ABS) – China – Ping An Insurance, Blackpine, CDH, China International Capital Corporation 2. Stripe: $5 billion / Payments – US – Khosla Ventures, Lowercase Capital, Redpoint Ventures 3. Social Finance (SoFi): $5 billion / Lending (Student Loans) – US – Baseline Ventures, Doll Capital Management,…

American Banker: 20 FinTech Companies to Watch

American Banker: 20 FinTech Companies to Watch Ripple: Develops software protocol underpinning a decentralized network for value transfer. IdentityMind Global: Fraud prevention, transaction monitoring, AML/KYC tools, sanctions screening. Trunomi: Lets financial institutions and customers create digitized sets of personally identifiable information and securely manage and share them. This accelerates and simplifies onboarding. Feedzai: Detects fraud in e-commerce by analyzing merchant,…

Fintech Payment Processing / Management Capital Raises – October 2015

Fintech Payment Processing / Management Capital Raises – October 2015 1. Bit9 + Carbon Black $54.5mm Series F (10/14/15) – .406 Ventures; Accomplice; Evolution Equity Partners; Founders Circle Capital; Highland Capital Partners;Kleiner Perkins Caufield & Byers;Sequoia Capital; The Blackstone Group 2. SteelBrick $48mm Series C (10/13/15) – Emergence Capital Partners; IVP;Salesforce Ventures; Shasta Ventures 3. Numerify $37.5mm Series C (10/22/15)…

Square IPO priced at $2.9 billion – down from $6 billion

Square (SQ: NYSE) priced its IPO at a valuation of $2.9 billion after being valued in a private financing last year at $6 billion. The shares were priced at $9 – down from the $11 – $13 price talk. Square, a mobile payments company was founded in 2009 – giving small businesses the ability to accept credit card payments through…

Earnest Raises $275 million

Earnest raised $275 million including a $75 million Series B (Battery ventures, Adams Street Partners, Maveron) and $200 million in a loan warehouse facility led by New York Life. Founded in 2013, Earnest refinances student loans and makes unsecured personal loans. Earnest is currently lending between $2 – $5 million per day – primarily student loans with an average…

The Future of FinTech – OrrickTotalAccess

The Future of FinTech – OrrickTotalAccess 10/6/15 Panel: Jon Stein, Founder & CEO, Betterment Charles Birnbaum, Vice President, Bessemer Venture Partners Pete Casella, Executive Director, JPMorgan Chase David Klein, Co-Founder & CEO, CommonBond Joe Proto, Chairman & CEO, Transactis Omar Qari, Co-Founder, Abacus Most of the panel discussion centered on what makes FinTech hard. The panelists generally agreed gaining the trust…

LoanDepot pulls IPO

LoanDepot pulled its IPO citing market conditions. The price talk was $16 – $18 per share with a mid-point valuation of approximately $2.5 billion or 30x earnings. Founded in 2010, Loan Depot is the 11th overall and 2nd largest non-bank residential mortgage lender with originations of over $21 billion through 9/30. Recently, LoanDepot has also branched out into unsecured consumer…

Rakuten Launches $100 million Global FinTech Fund

Global FinTech Fund: Rakuten launched a new US$100 million global investment fund focused on investments in disruptive early to mid-stage fintech startups that offer attractive return potential with strategic relevance. Rakuten’s prior fintech investments include Currency Cloud, WePay and Bitnet. Rakuten Group (4755:JP) is a global Internet service companies, providing a variety of consumer- and business-focused services including e-commerce, eBooks…

Fintech: HealthCare – October 2015 Capital Raises

Fintech: HealthCare – October 2015 Capital Raises 1. Collective Health $81mm Series C (10/20/15) – Founders Fund; Google Ventures;Maverick Capital; New Enterprise Associates; Redpoint Ventures; RRE Ventures 2. DrFirst $25mm Growth (10/14/15) – Goldman Sachs Private Capital Investing 3. CareSync $18mm Series B (10/07/15) – CDH Solutions; Clearwell Group;Greycroft Partners; Harbert Venture Partners; Merck Global Health Innovation; Tullis Health Investors…

Institutional Investor’s Fintech Finance 35 Ranking

Institutional Investor’s Fintech Finance 35 Ranking The Financiers who place the bets. James Robinson IV – RRE Ventures Jane Gladstone – Evercore Partners Matthew Harris – Bain Capital Ventures Steven McLaughlin – Financial Technology Partners Jonathan Korngold – General Atlantic Richard Garman – FTV Capital Amy Nauiokas – Anthemis Group Thomas Jessop – Goldman Sachs Group Mickey Malka – Ribbit…

3 Things All Successful FinTechs Have In Common

Successful FinTechs See 11/12/15 video from Lendit USA 2015 Closing Keynote by Ron Suber, President of Prosper Takeaways: 3 things all successful FinTechs have in common: – Capital, Product and Operations Capital: – Diversified – Varied risk appetite – Ready – “Permanent” Product: – Acceptance – Ease of use – Meet the needs – Customer experience – Repeat business –…

Risks and Potential Rewards Associated with Crowdfunding

Fundraising with online platforms can be rewarding but of high risk as well. There are no existing regulations clearly defined to govern it. For example, whether the international tax applies or not when the funding comes into being between countries is not clearly defined. In particular, if the rewards can be considered as sources of income or material possessions, whether…

Fintech: Lending – October 2015 Capital Raises

Fintech: Lending – October 2015 Capital Raises 1. Kabbage $135mm Series E (10/14/15) – BlueRun Ventures; ING Group NV;Recruit Strategic Partners; Reverence Capital Partners; Santander Innoventures; Scotiabank; Thomvest Ventures; UPS Strategic Enterprise Fund; Yuan Capital 2. Renovate America $90mm Growth (10/01/15) – 400Capital; DB Masdar; DFJ Growth;RockPort Capital Partners; Silver Lake Kraftwerk; Valor Equity Partners 3. Moven $12mm Series B…

Fintech Insurance Capital Raises – October 2015

Fintech Insurance Capital Raises – October 2015 1. Insureon $31mm (10/21/15) – Accretive LLC; Oak HC/FT 2. Knip $15.7mm Series B (10/26/15) – Creathor Venture; Orange Growth Capital; QED Investors; Redalpine Venture Partner; Route 66 Ventures 3. Censio $10mm Series A (10/06/15) – Bain Capital Ventures; General Catalyst Partners; Lakestar 4. GetSafe (Amt Not Disclosed) Series B (10/28/15) – Acton…

Fintech: Investing / Capital Markets – October 2015 Capital Raises

Fintech: Investing / Capital Markets – October 2015 Capital Raises 1. Symphony Communication Services (fka Perzo) $100mm Growth (10/12/15) – Google; Lakestar; Merus Capital;Natixis; Societe Generale Group; UBS 2. InvestCloud $45mm Series B (10/08/15) – FTV Capital 3. TruMid Financial $27mm (10/27/15) – Shumway Capital; Soros Fund Management 4. Stockpile $15mm Series A (10/13/15) – Ashton Kutcher; Mayfield; Sequoia…

Fintech: Payment Processing / Management Capital Raises

Date: 11/01/15 Industry: FinTech Posted by: Ken Margolis Fintech: Payment Processing / Management Capital Raises 1. Bit9 + Carbon Black $54.5mm Series F (10/14/15) - .406 Ventures; Accomplice; Evolution Equity Partners; Founders Circle Capital; Highland Capital Partners;Kleiner Perkins Caufield & Byers;Sequoia Capital; The Blackstone Group 2. SteelBrick…

Fintech: 3 Keys to Success

What Do Successful FinTechs Have In Common? See 11/12/15 video from Lendit USA 2015 Closing Keynote by Ron Suber, President of Prosper Takeaways: 3 things all successful FinTechs have in common: – Capital, Product and Operations Capital: – Diversified – Varied risk appetite – Ready – “Permanent” Product: – Acceptance – Ease of use – Meet the needs –…